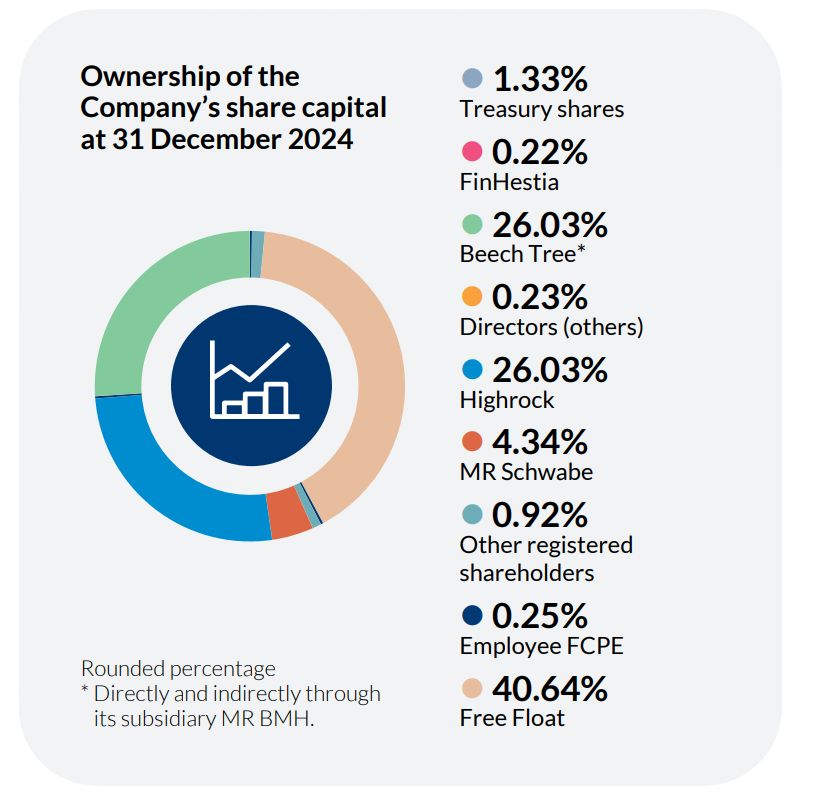

Shareholding structure

We aim to instill confidence across our investor community through open and transparent communication.

Ownership of Ipsen’s share capital (% of total capital)

The 2024 Annual General Meeting approved the payment of a dividend of €1.20 per share. This dividend was paid on 3 June 2024, the ex-date being 30 May 2024

Analyst coverage

Anas Patel

AlphaValue

Sachin Jain

Bank of America

Charles Pitman

Barclays

Florent Cespedes

Bernstein Société Generale Group

Victor Floc’h

BNP Paribas Exane

Arnaud Cadart

CIC Market Solutions

Niall Alexander

Deutsche Bank

Guillaume Cuvillier

Gilbert Dupont

Lucy Codrington

Jefferies

Richard Vosser

JP Morgan

Justine Telliez

Kepler Cheuvreux

Christophe-Raphaël Ganet

ODDO BHF

Simon Baker

Redburn Atlantic

Natalia Webster

Royal Bank of Canada

Xian Deng

UBS

ADR program

Ipsen has a sponsored Level I American Depositary Receipt (ADR) program via Deutsche Bank Trust Company Americas.

• Ticker: IPSEY

• Structure: Sponsored ADR Level 1

• Exchange: OTC

• Ratio (ORD:ADR): 1:4

• ISIN ADR: US4626291050

• ORD ISIN: FR0010259150

PROGRAM CO-COORDINATORS: Deutsche Bank Shareholder Services

c/o Equiniti Trust Company, LLC

Peck Slip Station

PO BOX 2050

New York NY10272-2050

United States

Email: adr@equiniti.com

Toll Free (within US): +1 (866) 706-0509

International: +1 (718) 921-8137

The Company’s ADR program is sponsored by Deutsche Bank. As depositary bank, Deutsche Bank performs the following roles for ADR holders:

• Registers and maintains the register of ADR holders

• Is the share transfer agent

• Distributes dividends in U.S. dollars (when declared by Ipsen’s board)

• Facilitates the proxy voting process and votes on behalf of ADR holders (if applicable)

• Issues and cancels the Issues and cancels Ipsen ADSs (American Depository Shares)

• May distribute company circulars and annual general meeting materials (if applicable)

For holders who are not registered because their shares are held through a ‘street name’ (nominee account), the Company may issue a proxy to the holder of the ADS). Nominees will receive materials from Deutsche Bank from time to time for distribution to ADR holders. Holders should make arrangements to receive these materials and to be able to vote through the custodian bank at general meetings, if applicable.

Contacts

Henry Wheeler

Vice President, Investor Relations

Khalid Deojee

Senior Manager, Investor Relations